Last Updated:

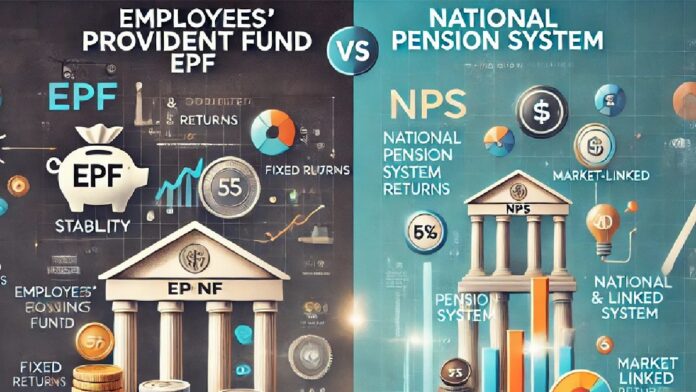

Both Employees’ Provident Fund (EPF) and the National Pension Scheme (NPS) are intended to give people a monthly pension and a lump sum payment after they retire; however, there is a fundamental distinction between the two.

EPF is a guaranteed return plan based on interest rates, whereas NPS is a market-linked investment programme.

In India, the Employees’ Provident Fund (EPF) and the National Pension Scheme (NPS) are the two most popular retirement pension plans. Both are intended to give people a monthly pension and a lump sum payment after they retire. There is a fundamental distinction between the two.

EPF is a guaranteed return plan based on interest rates, whereas NPS is a market-linked investment programme that allows investors to choose investment plans and managers according to their aggressive, moderate and cautious return strategies.

There is a probability that NPS will outperform EPF in the long run because it is market-linked. Some individuals may wish to move their EPF funds to market-linked returns NPS if they prefer them to fixed returns (EPF).

Employees’ Provident Fund: Details About It

EPFO, or Employees’ Provident Fund Organisation, is in charge of EPF. A compound interest of 8.25 per cent is offered on an employee’s EPF contribution annually.

The highest amount an employee can contribute is 12 per cent of their base pay and dearness allowance (DA). One of the benefits is that employers are required to make equal contributions to their employees’ Employee Provident Funds.

EPF deposits made up to Rs 1.50 lakh within a fiscal year are exempt from taxes. Additionally, withdrawals and interest are tax-free.

National Pension Scheme: Know More About It

Any Indian national between 18 and 70 can open an NPS account by going to an eNPS or Point of Presence-Service Provider (POP-SP) and providing their bank account information and PAN.

While NPS offers Tier II accounts with no lock-in term, Tier I accounts have a 60-year-old lock-in duration. A minimum annual payment of Rs 1,000 and a contribution of Rs 500 are required to start an NPS Tier I account.

You can start a Tier II account by contributing Rs 250. After that, no minimum balance is needed. Under Section 80 CCD (1), Tier I accounts provide tax benefits up to a total of Rs 1.50 lakh.

Only NPS subscribers are eligible for an extra deduction under subsection 80CCD (1B) for investments up to Rs. 50,000 in NPS (Tier I accounts). The NPS contribution made by an employer for the benefit of their employees up to 10 per cent of their base pay plus DA is deducted from their taxable income up to Rs. 7.50 lakh. For Tier II account holders, there are no tax advantages.

Is it possible to transfer EPF to NPS?

Yes, EPF transfers to NPS are possible for those having Tier I NPs accounts. To do that, the transfer request form must be sent to the employer. The transfer from the PF/superannuation fund is mentioned by the employer in the uploading note.

A cheque or DD is then made out to the private employee in the name of the Point of Presence, Collection Account (NPS Trust) and Subscriber Name (PRAN). On the other hand, a recognised PF or superannuation fund will send a check or DD to government personnel made payable to ‘Nodal Office Name – Employer Name – Permanent Retirement Account Number (PRAN)’.